4 Key Factors to Optimize Payment Integrity Performance

Healthcare costs are projected to continue to rise, with fraud, waste, and abuse consuming up to 10% of total spend. The stakes have never been higher for payment integrity teams tasked with curbing these costs. But too often, efforts are held back by fragmented data, outdated systems, and strained provider relationships.

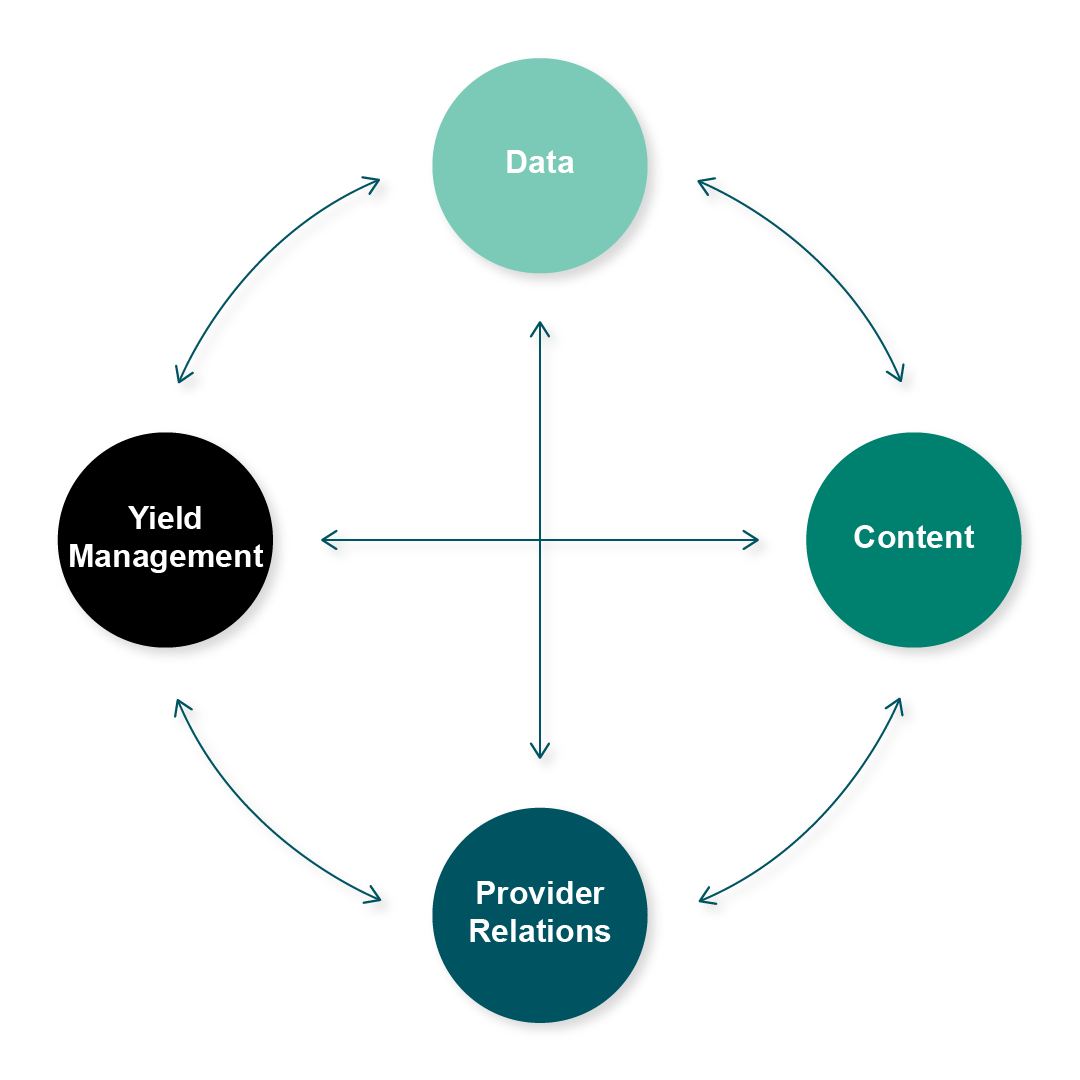

At Lyric, we’ve identified four interconnected factors that drive sustainable payment integrity performance:

1. Data: The Foundation

Data is the lifeblood of PI. Without comprehensive, unified access, PI teams operate with blind spots. Many plans rely on basic claims and savings data but lack longitudinal detail such as appeals, overturns, and conversion rates.

This fragmentation prevents health plans from answering critical questions:

Where can we reduce abrasion without losing savings?

Which vendors deliver the highest ROI?

Which providers would benefit from education?

Consolidating data across vendors and audits into a single source of truth unlocks the insights needed for smarter, more strategic decisions.

2. Content: The Engine

Content — edits and audit concepts — is what drives savings. But content is never static. It must evolve with emerging billing practices, regulatory changes, and public health dynamics.

Strong PI programs actively measure and adjust their content portfolio: what should move to pre-pay, what belongs to post-pay, and where vendors versus internal teams add the most value. Without this agility, health plans risk outdated strategies that erode savings.

3. Provider Relations: The Balance Point

Providers are essential partners in delivering member care, and inaccurate or delayed payments strain those relationships. With claim errors occurring 7–10% of the time, and scrutiny rising up to 4X, provider abrasion is a real threat.

The key is precision. Rather than shutting down entire audit concepts in response to provider complaints, data-driven PI teams refine their approaches, distinguishing between valid appeals and noise. This balance preserves savings while maintaining provider trust.

4. Yield Management: The Multiplier

Yield management is about converting findings into realized savings. Too often, manual recovery processes, opaque workflows, and missed automation opportunities keep yield rates stuck at 50–60%.

Imagine raising that to 80–90%. With the same teams and vendors, savings would increase dramatically while provider abrasion and administrative costs decline. Automation and transparency are the levers that make it possible.

The Lyric Advantage

By tuning all four factors together, health plans unlock maximum performance. At Lyric, our platform integrates data, content, provider insights, and yield management into one ecosystem — driving smarter, faster, and more collaborative PI operations.

Turn your payment integrity program into a true savings engine.

About Lyric

Lyric is the payment integrity Al company trusted by the nation's leading health plans at the beginning of the claims payment workflow. The Lyric platform is built on Al from the ground up and trained on 35 years of clinical expertise with real time integrations across 190 million lives. Lyric reduces wasted healthcare spending and ensures fast, accurate payments that drive transparency between payers and providers. Lyric is recognized as the 2025 Best in KLAS for Pre-payment Accuracy and Integrity.